First things first: Is today the top of the wave?

In a word: NO

At least I don't think so. I know a lot of people want to rush this count. But there are two very big reasons why I don't think it is done.

1) Tops are processes not events. By this I mean that the market is always predominately bullish. Bulls must exhaust a move in greed, which is done in fits and spurts at the end of an up wave. This is why we almost always see a cluster of reversal candlesticks at wave tops. Bottoms are different. Fear is the driver there and fear gets exhausted typically (not always) in one manic burst. But I stand by the idea that tops in equities at least are not found in one "blowoff" candle (this is of course subject to the size of the wave, but I doubt even a Minute degree wave ends in one daily candle).

2) I am highly skeptical of a huge downturn before Labor Day.

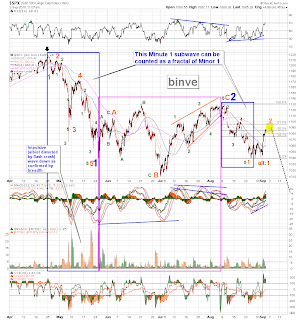

So now, here are the counts. I think today marks 3 of C of 2, not 5 of C of 2.

And for good measure, here is my sentiment chart. Historically speaking, things are still pretty bullish. I still see a lot of "everybody thinks everybody else is [bullish/bearish] which means we are definitely going [up/down]". This is a very dumb game of confirmation bias. See this post: Everybody is a contrarian indicator!! What is the actual sentiment like?.

Bottom line is: Make these calls by looking at market data. Sentiment surveys, while useful, measure what investors say not what they do (I *never* base decisions solely on these). However, the dumbest thing one can do is say that "all the blogs are (bullish/bearish) .... yadda, yadda, yadda" and make decisions based on that. Because if you do so, then you are looking only for the posts that fit your view (confirmation bias).